The Digital Banking Flywheel - Part 1

A story in 3 images

This is the first in a 2-part piece on how a freshly built tech stack can make digital banking tick. Part 2 will be published on 22nd Aug.

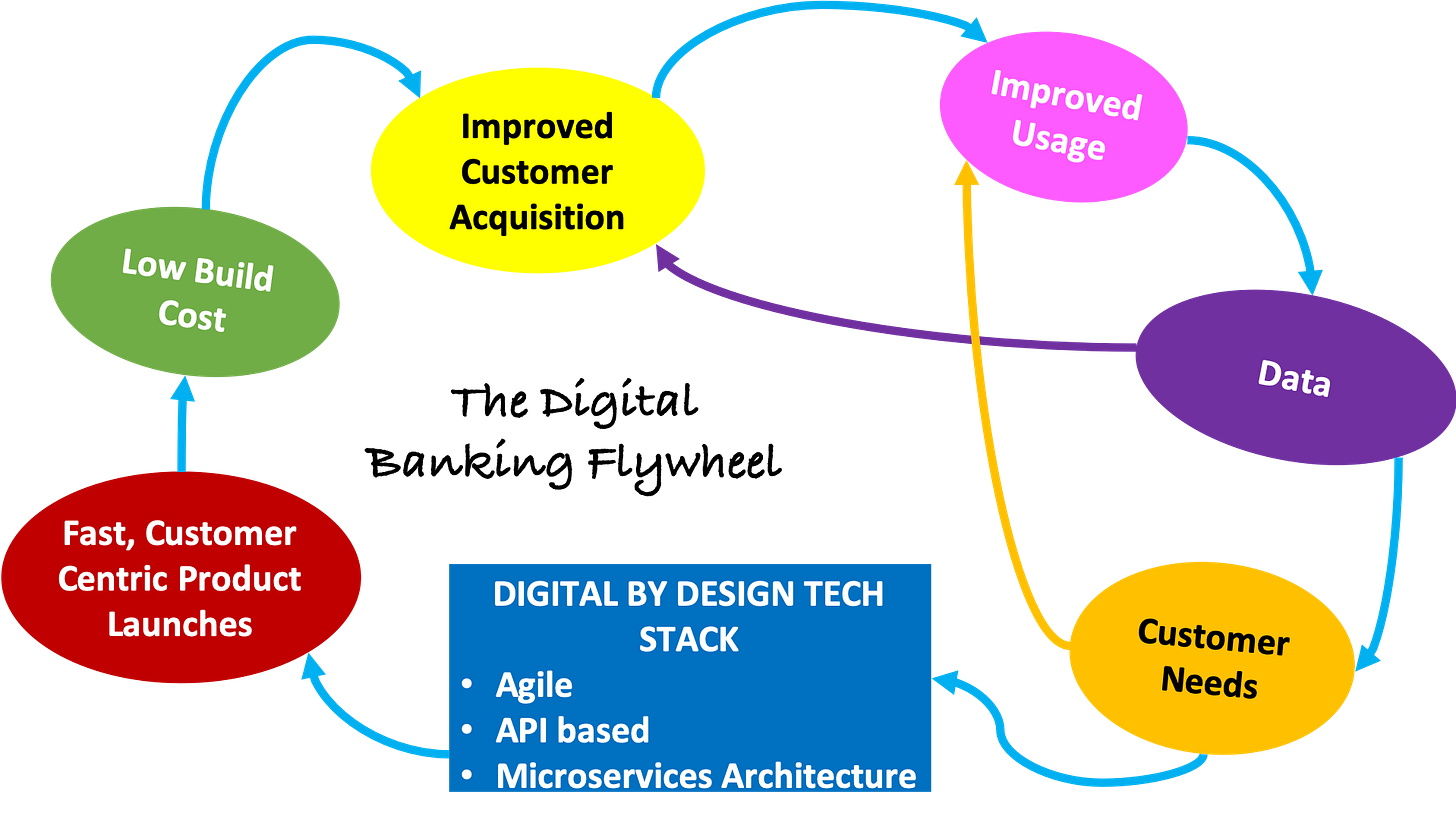

Today’s piece is all about 3 images. 2 of these images are of imaging devices and the third one is that of a digital banking flywheel - How a "freshly built" tech stack can drive a virtuous cycle of data driven product and feature releases and drive customer acquisition and usage for digital banks.

So let’s start with the first image.

If, for some unfathomable reason, an analogy was to be drawn between banking technology infrastructure and camera tech, then most legacy banks are using this:

Now if you are a customer who needs photographs, you’d need a soft copy, in colour and not b/w, in a format which is editable in any software, in a resolution which won’t get pixelated on the widest of screens. Your imaging service provider will definitely provide you all of this but for clicking the photo in the first place, it is going to use the above camera from 1936 Japan.

Imagine all the human effort and ultra-expensive software required to turn a photo clicked from *that* camera into an electronic, portable, editable, high resolution, colour format. And you know for sure that the output will not even be close to the same pic clicked from a humble mobile camera, such as the one below.

So when your imaging service provider takes 10 days and an exorbitant fee to deliver you a set of sub-par photographs, you will definitely ask them the question: Why don’t you just use a digital camera to click pics?

Luckily imaging service providers are practically fictitious in our world, or at best a part of our nostalgia. But a similar question on why they don’t go digital at the core is being asked to an organisation which is omnipresent in our day-to-day lives: banks. Legacy banks are running on decades old technology and have built a haphazard bunch of applications on top of that. This bunch of applications allows banks to offer many of the services their digital-native customers crave for: online payments, electronic statements, rewards, loyalty programs and security features to name a few very high level buckets. But these offerings are more often than not a checkbox, a hygiene factor so the bank can boast about its digital “capabilities” in its annual report, while entirely forsaking the spirit of what digital capabilities actually mean.

Look on the other hand at the multitude of fintechs and neobanks who have been able to disrupt legacy banks simply because they’re building afresh, from the ground-up. They don’t face the same technology constraints as legacy banks do, which include incredulous things like programs written in COBOL, and more importantly IT teams who are engrossed in managing dozens of technology vendors who help keep the lights on, rather than actually thinking about what should be the future technology on which the bank should run. They think that things are fine as long as the problem remains within the “IT department” and doesn’t spillover to business. Only problem with this mindset is that patchwork cannot remain always hidden from view - sooner or later it will spillover to the “business team”, the customer and the broader market in general.

With this in mind, it is worthwhile for legacy banks to explore a new tech stack, one which acts as the pivot for customer centric, data driven product development, which is unencumbered by legacy systems and does not pay heed to the ego of the bank’s high maintenance legacy IT infrastructure and the long list of expensive 3rd party vendor contracts. Here’s an image of what this flywheel looks like:

I’ll leave it here for today - more to come next week.