Credit scoring is a feature

There is no model credit model, anyone can assign you a credit score.

A cluster of a dozen residential society buildings in any urban locale in India is bound to have a go-to grocery shop. Its usually a small outlet, but has a very comprehensive collection of household consumables - basically everything that HUL, ITC, P&G, Marico and Dabur manufacture, plus some more. This unassuming store serves anywhere from 1000 to 2000 households on a regular basis, and the even more unassuming proprietor at the store knows entire families. The couple to whom he delivers milk every morning, another couple who prefers to pick it up after their morning walk, the granddad who shops for monthly staples, the kid who is allowed pocket money which affords him a pack of chips every week. He has internalised information about all these households, and will happily let most of them pick up stuff on credit.

Your local grocer gives you credit because he knows you well. Where you stay, who all are there in your household, what kind of bread you prefer. These data points which are not recorded anywhere work as excellent parameters to decide on your creditworthiness.

What if these parameters were to be somehow recorded, quantified and continually updated to assign a score - or better still - skip the score and directly assign a credit limit to each household. What if there exists a service which enables the capture of these “soft” data points, runs a model and churns out a step by step increase in credit limit with every purchase made by a customer. The end goal for your grocer would be to convert you from an occasional customer to someone who visits (or gets delivered from) your shop for all their grocery needs, and then settles the bill at the end of every month. This credit facility is a win-win for both you and the grocer. 3 key features of this kind of credit are noteworthy:

It is the grocery which is the lending instrument here - money is not disbursed but the end goal for which the money is to be used is met

The merchant is using proprietary data about the customer - critical data on preferences and household characteristics, which no one else has - or at least no bank has

FI Disintermediation: No credit score or bureau or financial institution is involved - the merchant is the lender

It is worthwhile to explore each of these facets of merchant lending in a bit more detail.

1. Goods / Services as the lending instrument

Merchants don’t transfer money when they give credit, they directly deliver the goods or services without upfront payment. While it’s fairly obvious how this works where there is an already existing relationship between the merchant and the customer, such an arrangement can also be had with a prospective customer who shows promise. A very interesting example of this is Meritize.

Meritize is a US based lender which looks at past achievements of prospective borrowers, in particular those looking to learn a new job-oriented skill. They do not look at FICO scores, and applying for a loan with Meritize has no impact on the FICO score either. They claim to gauge the borrower based on their past achievements, or a resume, if you will. To top it up, they have tie-ups with educational institutions to whom they directly pay the fees and even have a recruitment services arm to help their borrowers find jobs so they can repay their loan. So they evaluate the individual based on their capabilities, and not just a unidimensional past financial history.

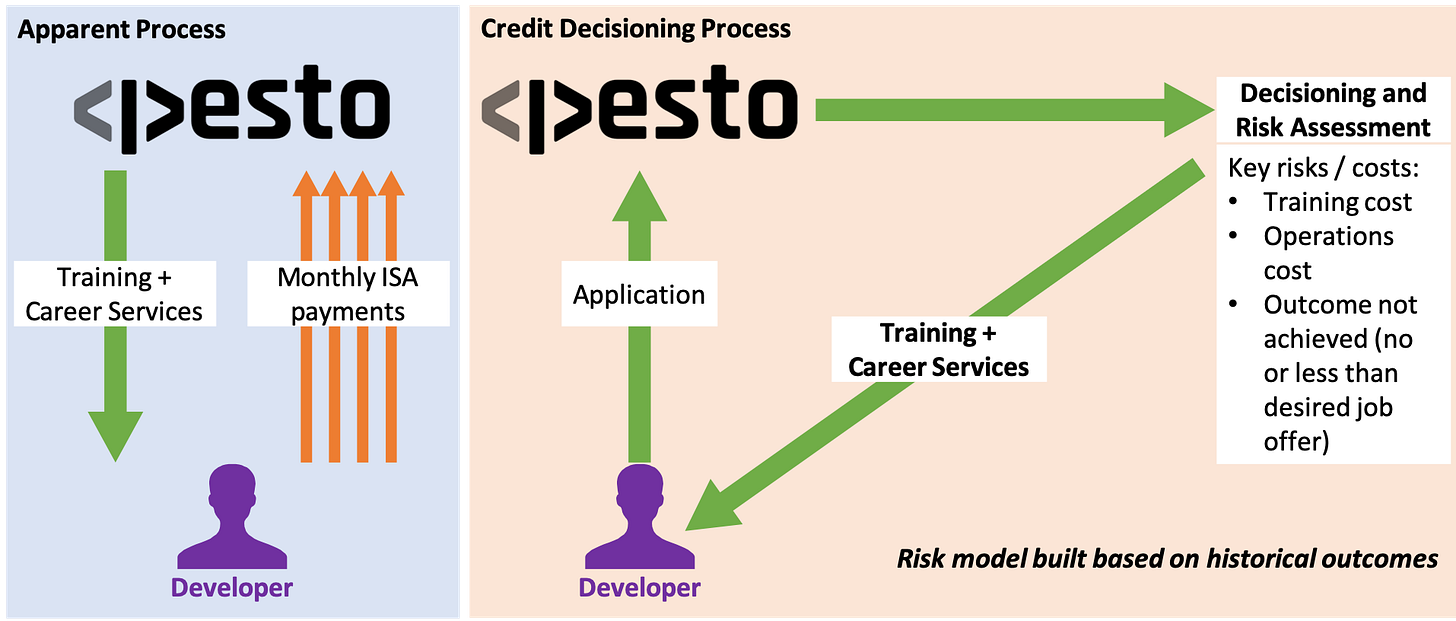

While the claimed core business of Meritize is still lending, Pesto technologies based in India is positioned the other way round - as a recruitment firm which on the other end trains developers. Once developers find a job, they pay back Pesto with 17% of their monthly salary for a period of 36 months up to a maximum limit of INR 2 million. This is executed via an Income Share Agreement or ISA, and the developer doesn’t have to pay any upfront amount for the training. So while Pesto is partly a recruitment business, partly an edtech, it is also a lender, where the cost of the service is capped at 2 million Rupees, and the service is being lent based on promise of future payments. There is of course a risk involved in terms of the applicant not being able to secure a job which pays 2x1 of what they were earning before attending Pesto’s program.

2. Use of Proprietary Data

Let’s zoom out a bit to see how this is playing out at a macro level. A recent Wall Street Journal article mentioned that FICO is losing its hold on the credit market. In case you’re not aware, FICO is the leading provider of consumer credit scores in the US, scoring more than 200 million Americans. Pretty much like the CIBIL score in India, FICO gives a 3 digit score ranging from 300 to 850 which provides a measure of the risk in lending to the borrower (higher score implies lower risk). After decades of reliance on these scores, lenders of all shapes and sizes - from big banks to new-age fintechs - are realising that the 3 digit number does not offer the complete picture of a retail customer’s ability and willingness to pay back a loan.

Modern day credit scores act as trusted neutral indicators of a borrower’s risk profile. These scores are computed using mathematical models which take borrowing and repayment history across multiple financial institutions as input. If risk profiling is the core problem in credit disbursement, then credit scores solve for this problem really well. But having said that, they look at only the historical financial behaviour of the borrower, and this has 2 obvious shortcomings:

History may not repeat itself: a prime borrower might turn sub-prime

Unidimensional limitation: customers without financial history might be turned down leading to loss of opportunity

One might argue that the risk of a prime borrower turning sub-prime cannot be averted by any model. There is nothing such as zero risk.

The second point though is where alternate lending has scored a big win, and banks have started tapping into their own data to see how they can make their credit decisioning models multidimensional. So this means that 3rd party credit scores become just one of the parameters which go into the decision making model. In terms of what kind of data can potentially go into a credit decisioning model, and what inferences such data might help make, the possibilities are endless.

Take for instance Neener Analytics, which provides solutions to predict a customer’s creditworthiness from their social profile and “how” they talk on phone. We’ve already seen how local grocers subconsciously build your credit profile based on their interactions with you.

A few days back fintech unicorn Razorpay announced the acquisition of TERA Finlabs, which provides a risk assessment SaaS platform to merchants, enabling them to offer credit solutions to their customers using proprietary data.

These are just 2 real-life instances of using non-conventional parameters to gauge a customer’s creditworthiness. Informal lending, for example, still works on a lot of heuristics, and it’s only a matter of capturing and modelling these heuristics as parameters in a credit decisioning engine.

3. FI Disintermediation

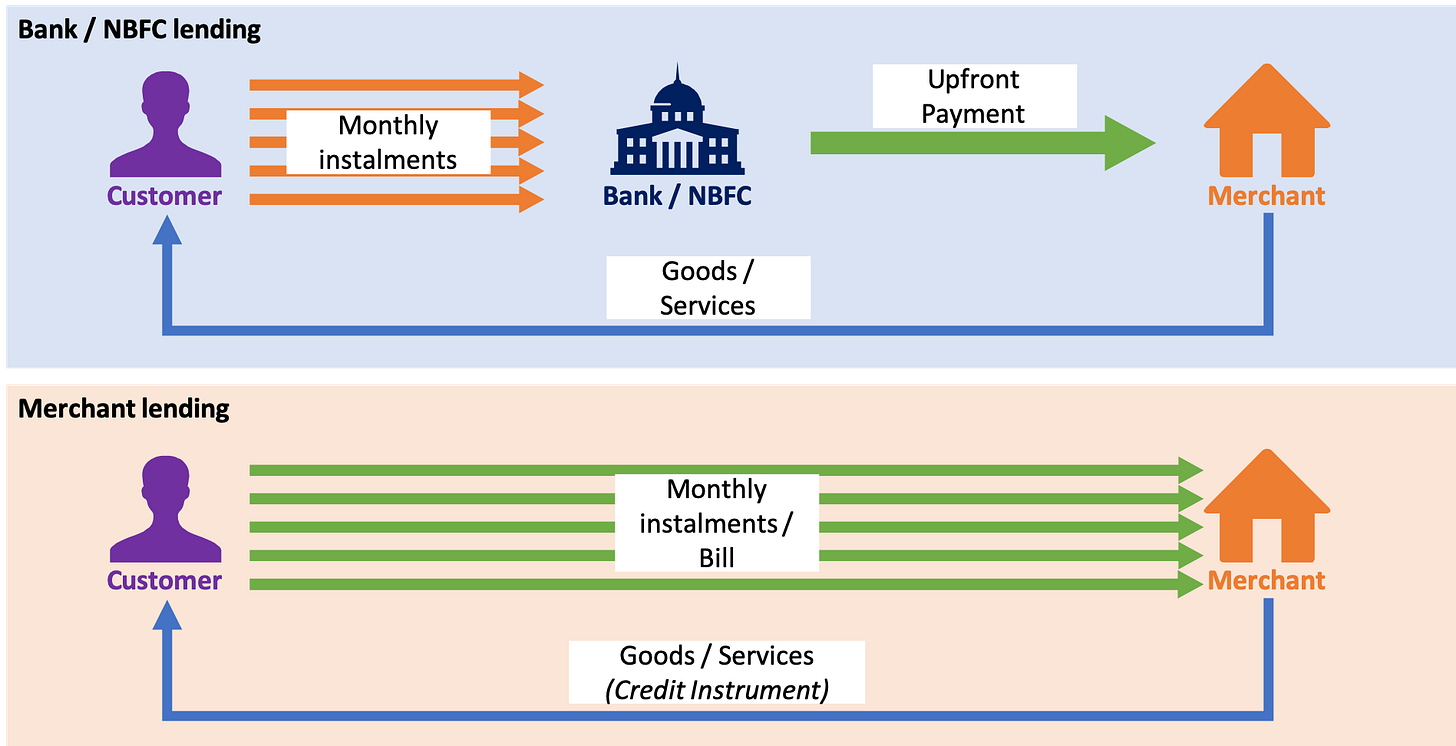

In a traditional model where a third party such as a bank or NBFC is involved, there is a monetary transaction which happens upfront. However, when the merchant directly delivers goods or services on credit no such upfront monetary transaction takes place, only the goods or services are transferred.

In the second scenario shown above, the merchant and the customer transact primarily based on what they know about each other. But we know that the second scenario is much less commonplace than the first one. The primary reason is that for medium to large ticket size purchases such as electronics, merchants usually do not have enough data to directly deal credit to customers, and giving credit is not their core competency either. They would rather have an intermediary to facilitate this process, even if they have to fund the interest on behalf of the customers. Hence the need for the Bajaj Finance representative in Croma stores.

Only if there was a way for the merchant to have enough information about the customer so they could give the product on credit to the customer without looking at their credit score.

What if there were a network of merchants enabling seamless data / information exchange about individuals - with their consent of course. What if this network would keep a record of an individual’s transactions, maybe tied to a common key such as their phone number or email id and using this record build a model to decide on that individual’s creditworthiness. What if the shared network could superimpose data from the individual’s social media profile to make the model more robust.

Might sound impractical I know, but its most certainly doable. Governments around the world, including India, are working towards establishing Open Data Frameworks for making shareable government data easily accessible. Of course there are concerns around privacy which I don’t mean to downplay, all of this needs to happen with the customer’s consent. Open banking is already a reality across many geographies in the world, and including retailers / merchants is the logical next step. In India we’re already on the cusp of an Account Aggregator revolution, and it won’t be long before data from all your financial accounts can be seamlessly brought together to deliver a multitude of services to you. Again, with your consent of course. The next step after account aggregators is generic data aggregators, which is what will enable anyone to churn out a score indicating creditworthiness.

I’d close out with a spin on Kunal Shah’s dictum.

Credit Scoring is a feature. Or soon will be.

Pesto claims that developers only have to pay the ISA amount if they get an offer which is 2x or more their previously drawn salary